If you want to guarantee yourself a particular yield and the bond has a call provision, enter your desired yield in the yield-to-call input and enter "0" (zero) for the price-to-call.Ĭaution: Be careful buying a bond with a call provision that is selling for a premium. This calculator will let you calculate either the price-to-call or the yield-to-call. price-to-call is what the purchaser will pay for the bond at a particular yield-to-call. NOTE: Callable at this amount should not be confused with the price-to-call input. The former bondholder now must find another investment. When the issuer calls the bond, the bondholder gets paid the callable amount. The date this can happen is the "call date". The issuer of the bond may have the right to 'call' the bond prior to maturity. The call date (if a bond is callable) is essential information when evaluating a bond. (Coupon interest, however, is most frequently paid semiannually.) To determine the dollars of interest paid annually, multiply the par value by the coupon rate. The coupon rate is the rate of interest a bond pays annually. Generally, the settlement date is one business day after the trade date for bonds of all types. The settlement date is the date that the buyer and seller exchange cash and securities. If you enter a '0' (zero) and a value other than 0 for the Yield-to-Maturity, SolveIT! will calculate the Current Price. If a bond is quoted at a discount of $86, enter $86 here.

#MATURITY DATE CALCULATOR HOW TO#

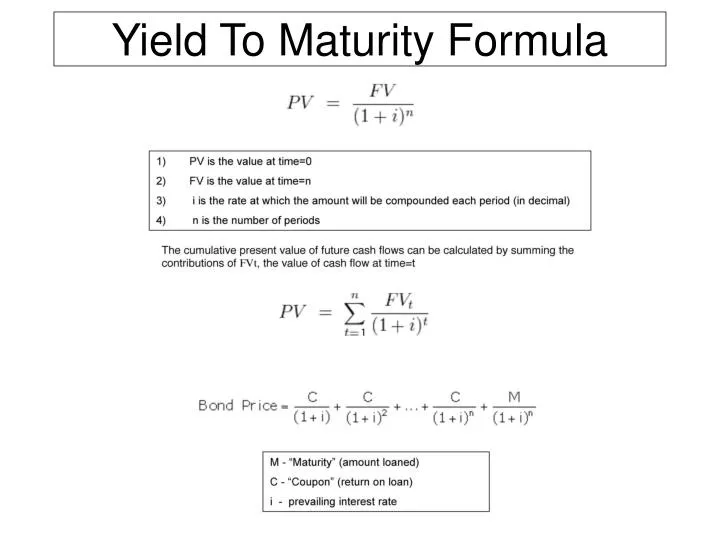

How to Use the Bond Calculator Your inputs:īond price - while bonds are usually issued at par, they are available in the resale market at either a premium or a discount. See this Wikipedia page for an introduction to fixed income investing. Or conversely, if you want to achieve a particular yield, enter the desired yield-to-maturity, and the calculator will calculate the amount you should pay for the bond. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity.

#MATURITY DATE CALCULATOR PLUS#

So if a bond broker quotes you a price of $93, you'll pay $930 plus perhaps accrued interest, fees, and commissions.Ĭalculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. However, by convention, bond prices are quoted as if the face amount were $100. When you purchase a bond, you are lending the bond's issuer money.īonds trade in established markets, usually in face amounts of $1,000. Governments and corporations issue bonds to raise cash (borrow money).

0 kommentar(er)

0 kommentar(er)